How Preventive Health Habits Could Lower Your Insurance Costs

Introduction to Health Insurance and Preventive Health Habits

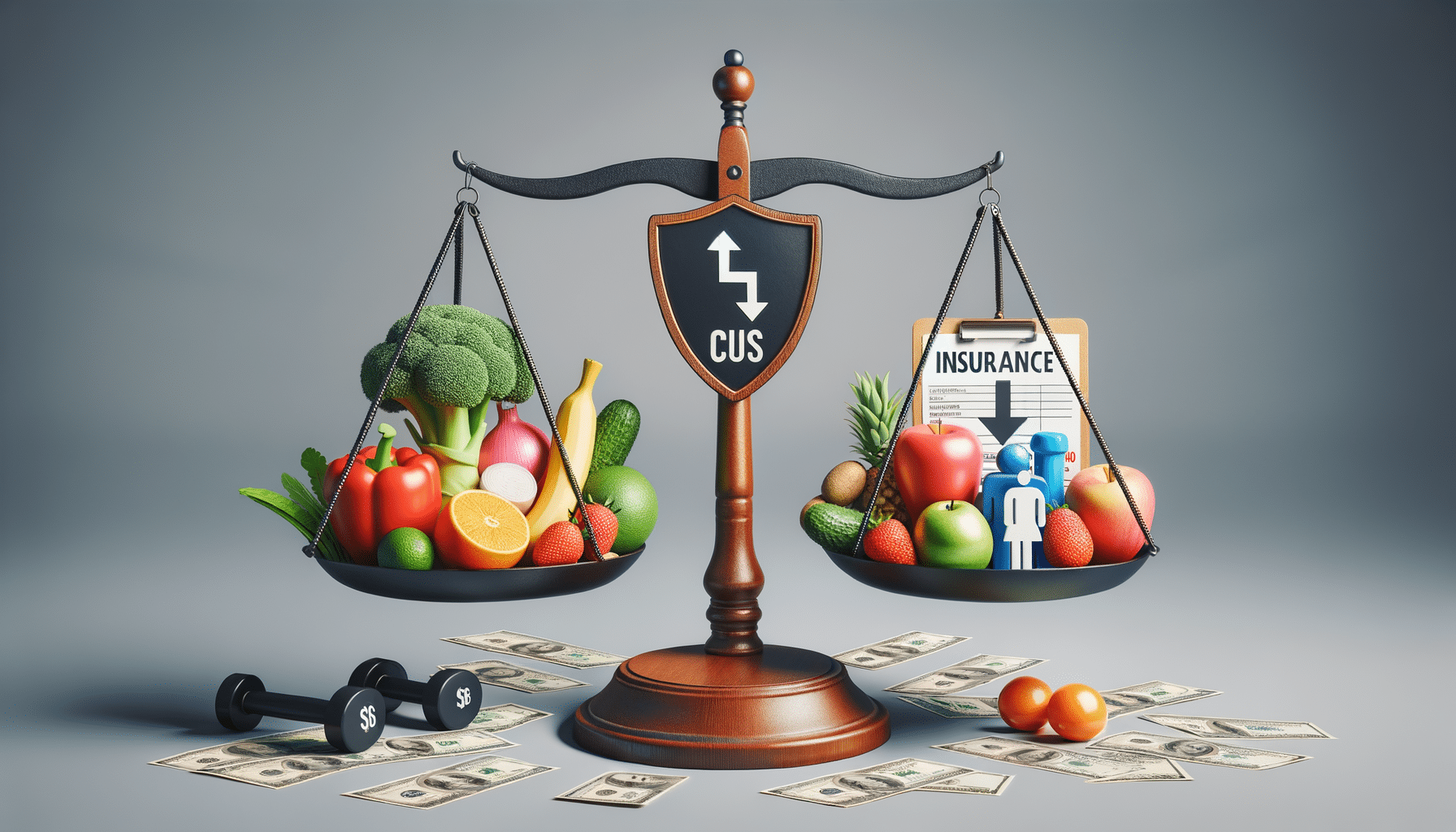

In today’s dynamic healthcare landscape, understanding the intricate relationship between preventive health habits and health insurance costs is crucial. Health insurance is not just a safety net for unexpected medical expenses; it can also be a tool for promoting healthier lifestyles. By adopting preventive health habits, individuals can potentially lower their insurance costs, making healthcare more affordable and accessible. This article explores how preventive measures, such as regular exercise, balanced nutrition, and routine health screenings, can influence the cost of health insurance and improve overall well-being.

The Impact of Preventive Health Habits on Insurance Premiums

Preventive health habits play a significant role in determining insurance premiums. Insurance providers often assess the health risks associated with policyholders to calculate premiums. Individuals who engage in regular exercise, maintain a balanced diet, and avoid harmful habits like smoking are generally considered lower risk. This lower risk can translate into reduced insurance premiums, as healthier individuals are less likely to require extensive medical care.

Moreover, many insurance companies offer wellness programs that reward policyholders for adopting healthy habits. These programs might include incentives such as premium discounts, cashback offers, or even free gym memberships. By participating in these programs, individuals can not only save on insurance costs but also enhance their overall health.

Some key preventive measures that can impact insurance premiums include:

- Regular physical activity, which helps maintain a healthy weight and reduces the risk of chronic diseases.

- A balanced diet rich in fruits, vegetables, and whole grains, which can lower the risk of heart disease and diabetes.

- Routine health screenings and vaccinations, which can detect potential health issues early and prevent serious illnesses.

Comparing Health Insurance Plans with a Focus on Preventive Care

When comparing health insurance plans, it’s essential to consider the coverage for preventive care services. Many insurance plans now include comprehensive preventive care benefits, such as annual check-ups, immunizations, and screenings, at no additional cost. These services are designed to catch potential health issues early, reducing the need for expensive treatments later on.

Individuals should carefully review the preventive care benefits offered by different insurance plans. Some plans may provide more extensive coverage for preventive services, while others might have limitations or require co-pays. It’s important to choose a plan that aligns with your health needs and lifestyle.

Additionally, understanding the network of healthcare providers included in the insurance plan is crucial. Access to a wide range of healthcare professionals and facilities can ensure timely and effective preventive care. By selecting a plan with robust preventive care coverage, individuals can take proactive steps towards maintaining their health while managing insurance costs effectively.

Conclusion: Embracing Preventive Health for Cost-Effective Insurance

In conclusion, embracing preventive health habits is not only beneficial for personal well-being but also plays a pivotal role in managing health insurance costs. By prioritizing regular exercise, balanced nutrition, and routine health screenings, individuals can present themselves as lower-risk policyholders, potentially leading to reduced insurance premiums. Furthermore, selecting insurance plans that emphasize preventive care can ensure access to essential services, promoting long-term health and financial stability. As healthcare continues to evolve, integrating preventive measures into daily routines remains a vital strategy for achieving cost-effective and comprehensive health insurance coverage.